Quantitative risk analysis is a numerical estimate of the overall effect of the risk on the objectives of the project, such as the cost and schedule objectives. The results provide insight into the likelihood of the success of the project and are used to develop contingency reserves.

A quantitative analysis:

- Creates realistic and achievable targets for costs, schedule, or scope.

- Quantifies the potential outcomes of the project and assesses the probability of achieving specific objectives for the project.

- Provides a quantitative approach to decision-making where there is uncertainty

To conduct a quantitative risk analysis, high-quality data, a well-developed project model, and a priority list of project risks will be required (usually from conducting a qualitative risk analysis).

There are three risk elements that concern project management:

- Schedule – Will the project be completed within the planned schedule?

- Cost – Will the project be completed within the budget allocated?

- Performance – Will the output of the project meet the business and technical objectives of the project?

Where possible, these risks should be quantified to allow the project team to develop effective risk mitigation strategies or to include appropriate contingencies in the project estimate.

How is Quantitative Risk Assessment Done?

The risks are identified and put on a list. Risks must be prioritized from this list, and then fed into a Risk Register. Then, these risks are ranked according to their severity and impact level by using distributions of probability to calculate the impact and probability of the risk. It also takes advantage of constraints such as schedule, cost estimates, and other resources.

Why to Perform a Quantitative Risk Analysis?

- Better Overall Project Risk Analysis: In the qualitative risk analysis individual risks are assessed. But the quantitative analysis enables us to assess the overall project risk from the individual risks plus other risk sources.

- Better Business Decisions: Business decisions are rarely made with all the information or data that we want. Quantitative risk analysis provides more objective information and data for more critical decisions than qualitative analysis. Keep in mind that while quantitative analysis is more objective, it is still an estimate. Wise project managers are considering other factors in the decision-making process.

- Better Estimates: The project manager estimated the duration of the project to be eight months at a cost of $400,000. The project actually lasted twelve months, costing $480,000. What happened? The project manager conducted a Work Breakdown (WBS) structure and estimated the work. However, the project manager failed to consider the potential impact on schedule and budget of the risks (good and bad).

When to Perform Quantitative Risk Analysis?

Firstly, we ‘re identifying risks. Then, we can qualitatively and quantitatively assess the risks. Consider using quantitative analysis of risks to:

- Projects where upper management wants more detail on the probability that the project will be completed on schedule and within budget.

- Projects requiring a contingency reserve for the schedule and budget.

Quantitative Risk Assessment Tools and Techniques

Quantitative Risk Analysis tools and techniques shall include but not limited to:

- Three-Point Estimate: A technique that uses the optimistic, most likely, and pessimistic values to make the best estimate possible.

- Decision Tree Analysis: A diagram showing the implications of choosing one or the other alternatives. The decision tree is a diagram of the decision Consideration and implications of choosing one or the other of the alternatives available.

- Monte Carlo Analysis: A technique that uses optimistic, most likely, and pessimistic estimates to determine the overall cost of the project and the project completion dates. For example, we could estimate the probability of completing a project at a cost of $20 million. Or what a company wanted to be an 80% probability of achieving its cost objectives. What is the cost of achieving 80%?

- Expected Monetary Value (EMV): Method used to establish contingency reserves for the budget and schedule of the project.

- Fault Tree Analysis (FMEA): Analysis of a structured diagram that identifies elements that may cause a system failure.

- Sensitivity Analysis: a technique used to determine which risks have the greatest impact on a project.

Quantitative Risk Analysis Example

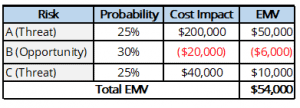

Let’s look at the following simple example of Expected Monetary Value (EMV):

Keep in mind that risks involve both threats and opportunities. Threats have an adverse cost impact. Opportunities are benefits that reduce costs.

Expected monetary value = probability x impact.

Note that we subtracted the benefit of the Opportunity from the EMV. The Total EVM value represents the project risk exposure and the amount of our Contingency Reserve.

The Bottom Line

Proper project risk management is an essential part of any project. It is an iterative process that continues throughout the project cycle. Quantitative risk analysis is a logical next step after qualitative risk analysis and should be performed at key stages of the project life cycle. It is a way of numerically estimating the probability that a project will meet its time and cost objectives.

Monte Carlo simulation is becoming the best weapon for project manager to quantitatively analyzing project risks. It is an extremely powerful tool that allows project managers to incorporate risk and uncertainty in their project plans and set reasonable expectations regarding schedule and cost and on their projects.

The results of simulation are quantified, allowing project managers to better communicate their arguments when management is pushing for unrealistic project expectations. However, Monte Carlo simulation is still not very popular in current project management practice, primarily due to its statistical nature.

See Also

Qualitative Risk Analysis

Risk Management Plan

Risk Excel Template

RACI Chart Matrix